|

| Source: Fiscal.wa.gov, April 6 |

If the House isn't fully funding special education, what are they funding instead?

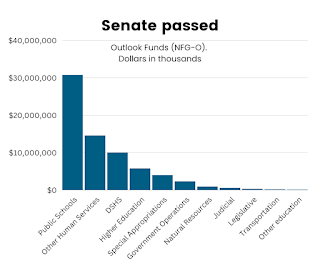

In the proposed state operating budgets, both House and Senate put similar amounts into public schools ($30.8 billion versus $30.7 billion), but the Senate proposes more than twice as much for special education.

The House is offering $200 million less for special education.

So, what gives? What does the House want to fund, instead?

Turns out, the House has $389 million more going to offset unfunded liability costs for educator pensions. Special education and unfunded accrued actuary liability (or UAAL) are the biggest discrepancies between the proposals.

|

| Source: Fiscal.wa.gov, April 6 |

The charts at right look how the House and Senate propose to allocate state funds. They show how total allocations would be spread out among state services. When they come to totals, both track similarly. Translated, “NFG-O” means Near General Fund Outlook. That term means the money the state expects to raise from state taxes and fees.

- You can look at the line items for public schools, here.

- You can find other budget comparisons, here.

Here is what those budget lines refer to:

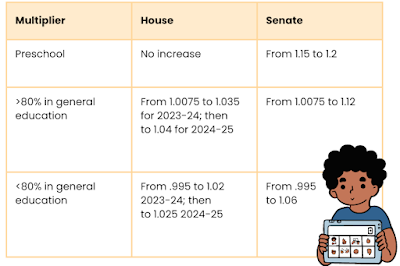

MULTIPLIER:

Each school district gets a per pupil apportionment to cover general

education. The amount varies by district, depending on student and staff

factors and where in the state they are. To determine each district’s

special education funds, the state multiplies the district's general

apportionment by a set number (“the multiplier”). The state uses

different multipliers, depending on how much time the students spend in

the general education setting, and whether or not they are in K-12 or

preschool.

The House increases the multiplier for K-12, only.

The Senate increases it for preschool and K-12 special education services, and uses higher multipliers.

Here is what is proposed for the 2023-25 biennium budget:

|

| ESHB 1436 (as passed House) and E2SSB 5311 (as passed the Senate) |

Note: The House proposes to continue increasing the multiplier through 2026-27, to 1.059 for K-12 when spending 80 percent or more of the day in general education, and 1.043 when spending less than 80 percent of the day in general education. Schools would still get substantially for special education, compared to the Senate proposal.

CAP:

The state caps funded enrollment for special education services. If

districts have too many students using services, they need to spread

funding more thinly or try to raise funds locally to cover the gap.

Currently, the cap is 13.5 percent full-time equivalent (FTE) students.

Advocates have asked to remove the cap. The House agrees to phase it out

by 2028, starting with 14 percent in 2023-24, then 14.5 percent in

2024-25. The Senate does not agree to phase it out but would immediately

raise it to 15 percent. The Senate's approach provides more funding in the next

budget.

ARPA IDEA: Federal COVID relief funds are rolled over.

IDEA PRESCHOOL: Federal COVID relief funds are rolled over.

INCLUSIONARY PRACTICES PROJECT: This is a state professional development program to support inclusion of students with disabilities in general education.

SAFETY NET: School districts can apply to recover costs for exceptionally expensive IEPs. Districts can apply if the cost of an individual IEP exceeds 2.3 times the average per-pupil expenditure. Both House and Senate would lower the threshold.

- House: Lowers from 2.3 to 2.2 times the average per-pupil expenditure

- Senate: Lowers from 2.3 to 2 times the average per-pupil expenditure for small school districts (fewer than 1000 FTE students); and lower to 2.2 times the average per-pupil expenditure for larger school districts (1000 or more or more FTE students).

EXTENDED TRANSITION: This funds recovery services for older students who did not get adequate transition services during the pandemic. The House re-appropriates federal funds to continue providing transition supports for students with disabilities who would otherwise age out in the 2023-24 or 2024-25 school years, and who do not graduate with a regular diploma.

SUMMER EVALUATIONS: This would fund HB 1109, which makes funding

available to school districts willing to do summer evaluations, for a limited

time, to help with the pandemic backlog.

So, what did the House fund, instead?

The House puts about $200 million LESS into special education.

Its budget proposal for K-12 spending has more policy changes that need funding, but

the biggest cost differences seem to be for pension plans and benefits. Here

are some of the larger line items for public schools that the House budgets for and the Senate does not:

- $14 million to fund HB 1479 – the bill to phase out isolation by building up professional capacity (it died in the Senate)

- $23 million to offset regionalization changes (this affects general apportionment)

- $19.6 million to pay for dual credit (community college courses for high schoolers)

- $26 million to expand free school meals

- $47 million more than the Senate for school employee benefits

- $389 million more than the Senate for school

employee pension plans

How much of the budget goes to education?

Our state constitution says education is the paramount duty of the state. Many people look to see what percentage of the budget goes to K-12 education, and they use that as a gauge for whether the state is meeting its paramount duty.

Both Senate and House budgets put in about 44 percent of state funds into K-12 public schools. If you added in higher education and the state’s preschool program, the Early Childhood Education and Assistance Program (ECEAP), then both put about 52 percent of the state dollars into education.

Over the next two weeks, legislators will be negotiating the final budget.

That budget will be much bigger because it will include matching federal funds for health care and other services.

.png)